When you’re facing an unexpected expense or a temporary cash flow gap in a bustling city like Seoul, the need for quick funds can be immediate and stressful. You might find yourself searching for credit card cashing services, a term that often leads to a confusing mix of legitimate financial tools and risky, unregulated offers. The path to securing emergency funds shouldn’t be fraught with uncertainty or legal ambiguity.

This guide is designed to cut through the noise. We will provide a clear, comprehensive overview of your legal and safe options for accessing cash advances in Seoul. Unlike other guides, we will offer an unparalleled, actionable walkthrough for navigating the often-frustrating micropayment policies of major Korean carriers like SKT, KT, and LG. By the end of this article, you will have the knowledge and confidence to make a financially sound and legally compliant decision for your immediate needs.

Understanding Card Cashing Services in Seoul: What You Need to Know

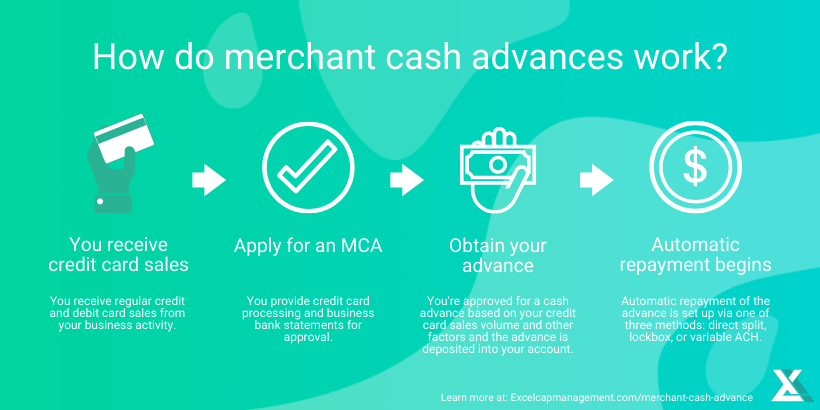

In the Korean context, “card cashing” (신용카드 현금화) refers to the process of converting your available credit limit into physical cash. While the term can sometimes be associated with illicit activities, it’s crucial to understand that there are perfectly legal and regulated methods to do this. This 신용카드 현금화 가이드 (credit card cashing guide) focuses exclusively on those legitimate avenues.

Legitimate methods typically fall into two categories:

- Direct Bank Cash Advances: Nearly all credit cards issued by Korean banks offer a “cash advance” (현금 서비스) feature, allowing you to withdraw cash from an ATM up to a certain limit. This is a direct loan from your card issuer.

- Gift Certificate Cashing: This method involves purchasing a marketable item, like a digital or physical gift certificate, with your credit card and then selling it to a registered, compliant service for immediate cash. This is a legitimate commercial transaction.

It is vital to distinguish these from illegal practices. Illicit services often involve creating fake transactions or using deceptive methods that can lead to severe consequences, including illegal card fraud. Our focus is strictly on legal cash advance Korea options that prioritize your financial safety and compliance.

Legal vs. Illegal Card Cashing: Protecting Yourself

Navigating the world of instant cash can be risky if you don’t know the warning signs. Illegal services and unregulated private money lenders Korea often prey on those in urgent need. Protecting yourself starts with recognizing the red flags.

Warning Signs of an Illegal Service:

- Requests for Your Physical Card or Full Card Details: A legitimate service will never ask you to hand over your credit card, PIN, or full security information.

- Excessively High, Hidden Fees: Illegal operators often lure you in with promises of low rates, only to hit you with exorbitant and undisclosed fees.

- Lack of a Registered Business: A trustworthy provider will have a clear business registration and a physical or verifiable online presence.

- Pressure to Act Immediately: High-pressure tactics are a common sign of a scam.

According to Korean financial regulations Seoul, engaging in fraudulent transactions can have serious legal repercussions for both the provider and the user.

Our Commitment to Compliance: Star Gift Certificate never engages in illegal card fraud, false transactions, or transactions under someone else’s name. Our services are provided only within the scope of compliance with relevant laws and regulations. For your protection and ours, transactions can only be made using a card and an account registered in your own name.

Comparing Legitimate Card Cashing Options in Seoul

When you need safe card cashing in Seoul, you have several compliant avenues. Let’s compare the most common ones.

| Option | How It Works | Pros | Cons |

| Bank Credit Card Cash Advance | Withdraw cash from an ATM using your credit card’s cash advance feature. | – Direct & Simple- Regulated by banks | – High interest rates from day one- Can negatively impact credit score- Strict limits |

| Gift Certificate Cashing | Purchase a gift certificate with your card and sell it to a service like Star Gift Certificate’s Service Page for cash. | – Fast & accessible- No direct impact on credit score- Often lower fees than cash advance interest | – Requires a reputable, registered service- Service fee applies |

| Regulated Card Loan Korea | A short-term personal loan from a licensed financial institution, often based on your credit card history. | – Structured repayment plan- Regulated interest rates | – Requires an application process- May take longer to receive funds- Eligibility checks required |

For many, gift certificate cashing offers a balanced solution, providing the speed of a cash advance without the high interest rates and direct impact on credit scoring.

A Complete Guide for SKT, KT, and LG Users: Bypassing Micropayment Policies

One of the biggest hurdles for using your card for online purchases including gift certificates can be your mobile carrier’s micropayment policies 소액결제 정책. These limits are in place for your protection but can be frustrating when you need to make a legitimate transaction. Here’s how to navigate them.

What Are Micropayment Policies and Why Do They Exist?

Mobile micropayments allow you to charge small purchases directly to your phone bill. Carriers like SKT, KT, and LG set monthly and per-transaction limits on this service to prevent fraud and help users manage spending. When you try to purchase a gift certificate or other digital goods, you might hit this limit, causing the transaction to fail.

Strategies for Bypassing SKT Micropayment Policies

If you’re an SKT user, a failed transaction due to policy limits can be resolved. Here are some effective SKT micropayment solution strategies:

- Adjust Your Limit via the T World App: The easiest method is to log into your T World app or the SKT website. Navigate to the micropayment (소액결제) section and check your current limit. You can often request an increase directly within the app, subject to SKT’s internal credit policies.

- Use Alternative Payment Methods: For larger purchases, SKT often encourages using direct credit card payment gateways (like Pay-Pin) instead of billing to your phone. When purchasing from a service, see if they offer a standard credit card processing option.

- Contact SKT Customer Service: If you are unable to adjust your limit online, a direct call to SKT customer service (dial 114 from your mobile) can sometimes resolve the issue, especially if you have a good payment history.

Navigating KT’s Small Payment Limits

KT users face similar challenges. To manage KT small payment limits, follow these steps:

- Check and Manage Limits on the My KT App: Like SKT, KT provides tools for managing your micropayment limits within the My KT application or on their website. Verify your limit and see if an increase is available.

- Utilize KT’s Content Payment Services: KT may have different limits for general micropayments versus “content payments” (콘텐츠 이용료). Ensure you are using the correct payment method for the type of goods you are purchasing.

- Confirm Your Identity: Sometimes, transactions are blocked pending further identity verification. Follow any on-screen prompts or SMS messages from KT to confirm that you are the one making the purchase.

Understanding LG U+’s Cash Advance Rules & Limits

For LG U+ users, the process is similar. Here’s how to handle LG U+ cash advance rules and payment limits:

- Use the U+ Customer Center App: Your primary tool is the U+ Customer Center app. Log in to view your micropayment (소액결제) and content payment (콘텐츠 이용료) limits and request adjustments.

- Register a Secure Payment Method: LG U+ may require you to register a primary credit card or bank account for larger or recurring payments. Ensuring this is set up can help streamline future transactions.

- Direct Customer Support: If app-based solutions fail, contacting LG U+ customer support (114) is the most direct way to inquire about a temporary or permanent limit increase.

How to Choose a Safe and Compliant Card Cashing Service in Seoul

Choosing the right service is paramount for a safe and positive experience. Use this checklist to evaluate any provider:

- Transparency: Are all fees and terms stated clearly upfront? A reputable service will have no hidden charges.

- Legal Registration: Does the company have a valid business registration in Korea? This is non-negotiable.

- Secure Process: Does the process protect your personal information? You should never have to provide your card’s PIN or full CVC code.

- “Own Name” Policy: The service must strictly enforce a policy that the credit card, mobile phone, and bank account used for the transaction all belong to you. This is a key indicator of compliance and a safeguard against fraud.

- Customer Support: Is there a clear way to contact them for help? Reliable support is a sign of a professional operation.

At Star Gift Certificate, we are built on these principles of responsible borrowing and transparency. To learn more about our commitment to legal and ethical standards, please visit our About Us page.

FAQs about Card Cashing & Micropayment Bypass

Is card cashing legal in Korea?

Yes, when done through legitimate methods like a bank-issued credit card cash advance or by using a registered gift certificate cashing service. Illegal methods involving fraudulent transactions are strictly prohibited.

How quickly can I get cash?

Bank cash advances are instant at an ATM. With a service like Star Gift Certificate, the process is extremely fast. Cash is typically transferred to your account within minutes of completing the transaction.

What documents do I need?

For most services, you will only need to prove that the card, phone, and bank account are in your name. This is a standard identity verification step to prevent fraud. You should not be asked for sensitive documents beyond what is necessary for this verification.

Can I increase my micropayment limit permanently?

Carriers may allow permanent limit increases based on your tenure and payment history with them. However, most online adjustments are temporary or subject to monthly review.

What are the risks of using unregulated services?

The risks are severe: identity theft, exorbitant hidden fees that trap you in debt, and potential involvement in financial fraud. As advised by consumer protection agencies like the Korea Consumer Agency, always stick to registered and compliant providers.

Your Path to Safe and Immediate Funds

Navigating the need for quick cash in Seoul doesn’t have to be a gamble. By understanding the difference between legal and illegal services, comparing your legitimate options, and knowing how to manage carrier micropayment policies, you can take control of your financial situation responsibly.

Star Gift Certificate is dedicated to providing a secure, transparent, and fully compliant pathway to accessing the funds you need. We believe in empowering our clients with knowledge and providing a service that meets the highest standards of safety and integrity.