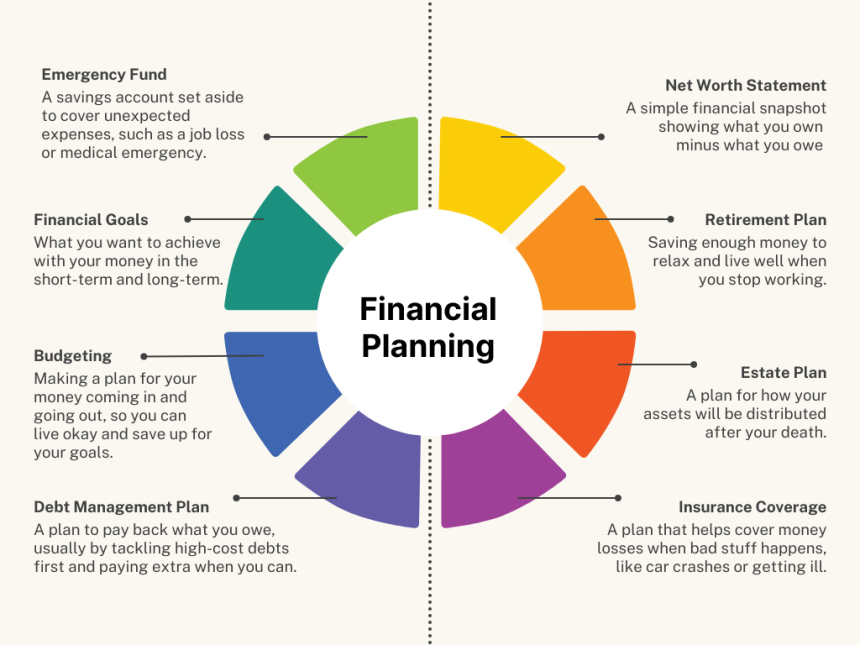

Whether it’s your personal or business finances, you can partner with wealth planners to improve your financial wellness. Professionals assess your situation to craft a financial plan that supports you now and in the future. Here are a few key components of financial planning services that a wealth planner can help with:

Planning for Education Expenses

Financial planning for education expenses enables families to understand their needs and supports participation in further education, ultimately achieving their goals. With the help of a wealth planner, you can build a savings plan that addresses your family’s educational needs. This financial professional evaluates the projected cost to craft a suitable savings plan. The aim is to help you set aside funds gradually to avoid future financial strain.

Read also: Metatrader 4 Iphone ios

Understanding Your Cash Flow

A financial plan should examine your cash flow, including where your money comes from and where it goes. Understanding your cash flow may help you stay focused on your financial goals. Financial professionals will review your income and expenses to understand your financial health. After assessing your financial situation, they will help you develop an investment strategy designed to support your long-term financial goals. Effective cash flow analysis can also help businesses cover all operational expenses and pay debts without facing financial instability. See more about managing cash flow and exploring funding solutions that align with your financial objectives.

Building Savings and Emergency Funds

An emergency fund offers resources for unexpected expenses such as job loss, medical issues, or urgent home repairs. Establishing this fund involves careful financial planning to prepare for possible financial needs. Having funds set aside can provide flexibility when unforeseen costs arise.

A wealth advisor helps create savings strategies tailored to your unique financial situation and goals. They may suggest suitable accounts, such as checking or savings accounts, to keep funds accessible when needed. These professionals also review your financial priorities periodically to help adjust your plan as circumstances change.

Creating a Personalized Budget

A well-structured budget outlines how your money is allocated each month. Financial planning professionals can help you create a budget tailored to your lifestyle. The budget typically includes income, savings targets, and expenses. It helps allocate funds to necessary costs such as groceries, car repairs, and healthcare. Budgeting can also help identify areas where expenses can be adjusted to support your savings goals.

Preparing for Major Purchases

Making big purchases requires setting clear financial goals aligned with your aspirations. Whether buying a home or a vehicle, creating a detailed savings plan is often advised. Establishing these goals helps you understand your spending and manage your finances.

Wealth planners assist in developing financial strategies to help you manage your budget and allocate funds as needed. They design tailored savings plans to raise funds within a timeframe that suits your needs and goals. This structured approach supports individuals, families, or businesses in preparing for significant expenses, providing greater financial control and potentially reducing reliance on loans.

Partnering with a Wealth Planner for Your Financial Goals

Proper planning helps you manage your money in line with your financial goals. Wealth advisors offer guidance on developing savings strategies tailored to your specific needs. They review income and expenses to help create a budget aligned with your lifestyle. Contact a trusted wealth planner to learn about financial planning services.